Get a $75 Cash Bonus

Earn up to $950* in value in the first 12 months, including up to 45,000 bonus Scene+ points. Offer ends October 31, 2024.

Offer valid until: Aug 30th, 2024

Find the right credit card.

Get StartedCashSurge increases the value of credit cards by introducing an additional cash bonus. We’ll pay you up to $125 every time you are approved for a CashSurge credit card.

Get a $75 Cash Bonus

Earn up to $950* in value in the first 12 months, including up to 45,000 bonus Scene+ points. Offer ends October 31, 2024.

Offer valid until: Aug 30th, 2024

Get a $75 Cash Bonus

Earn 10% cash back on all purchases for the first 3 months (up to $2,000 in total purchases)1. Plus, no annual fee in the first year, including on supplementary cards1. Offer ends October 31, 2024.

Offer valid until: Aug 30th, 2024

Get a $100 Cash Bonus

You could get a 0% promotional annual interest rate ("AIR")† for 12 months on balance transfers✪ completed within 90 days of account opening, with a 3% transfer fee.

Offer valid until: Aug 30th, 2024

.png)

Get a $50 Cash Bonus

Get up to 10% cash back in your first 3 months and the $120 annual fee waived in the first year*

Offer valid until: Aug 30th, 2024

.png)

Get a $150 Cash Bonus

Earn an extra 10% back* (up to $100) when you spend up to $1,000 in everyday purchases within your first 2 months.* (Apply by October 31, 2024)

Plus, During your first 30 days, transfer balances and pay only 1.95% interest on the transferred balance for the first 6 months (19.95% after that)†.

Offer valid until: Aug 30th, 2024

Get a $100 Cash Bonus

5,000 bonus points†† after you make $500 or more in eligible purchases within the first 90 days of your account opening. Plus, 5,000 bonus points†† once enrolled for paperless e-statements within the first 90 days of account opening

And 4 points†† for every $1 spent on eligible restaurant, grocery, digital media, membership and household utility purchases during the first 90 days (until $10,000 is spent annually in the applicable category)

This offer is not available for residents of Quebec. For residents of Quebec, please click here.

Offer valid until: Aug 30th, 2024

Get a $50 Cash Bonus

Get up to 60,000 points worth $400 in travel rewards, a $50 anniversary lifestyle credit and the $120 annual fee waived in your first year – that's a $570 value achieved by your first anniversary.

Offer valid until: Aug 30th, 2024

Get a $150 Cash Bonus

Earn an extra 10% back* (up to $100) when you spend up to $1,000 in everyday purchases within your first 2 months.* (Apply by October 31, 2024).

Plus, during your first 30 days, transfer balances and pay only 1.95% interest on the transferred balance for the first 6 months (19.95% after that)†.

Offer valid until: Aug 30th, 2024

Get a $50 Cash Bonus

Get 20,000 points when you spend $1,500 in the first 3 months - that's a $133 value!* Plus, earn up to 5,000 bonus points every year.

Get a 0.99% introductory interest rate on Balance Transfers for 9 months, 2% fee applies to balance amounts transferred.*

Offer valid until: Aug 30th, 2024

Get a $50 Cash Bonus

$60 cash back when you make a mobile wallet purchase within the first 90 days and 6 automatic payments within the first 8 months for your Rogers, Fido or Shaw postpaid service.

Offer valid until: Aug 30th, 2024

Get a $50 Cash Bonus

Earn 5% cash back for your first 3 months (up to $2,500 in spending). Plus, get a 0.99% introductory interest rate on Balance Transfers for 9 months, 2% fee applies to balance amounts transferred.*

Offer valid until: Aug 30th, 2024

Focus On

When you compare cash back credit cards, look at the rewards rates they offer relative to their annual fees. Some cards have great rewards rates that let you earn at least 2% cash back but then charge a big annual fee. You'd have to spend a lot of money on a card like that to make the premium rewards rate worthwhile.

Savvy shoppers should estimate how much money they'll spend with their cash back credit card each year and choose a card accordingly. Big spenders will benefit from premium cash back cards offering high rewards rates. Lower to middle-income consumers will find that standard cash back cards make more sense.

You should also think about the kind of items you spend money on each month. Many cash back cards offer higher rewards rates for certain categories of purchases, like gas, groceries, and recurring bills. If you spend a lot of money on one type of item, look for a cash back card that gives you an optimal rewards rate on it.

Check out our table below to see the rewards rates and benefits on some of our most popular cash back cards:

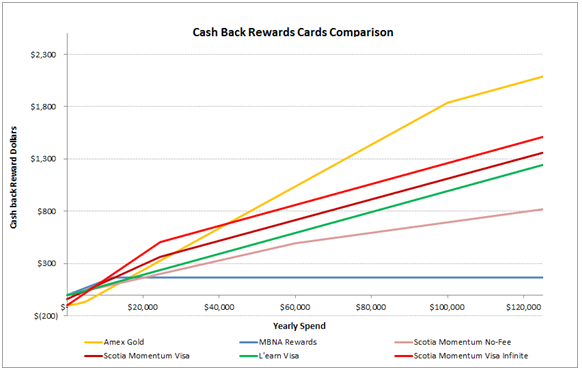

We put a selection of cash back credit cards head-to-head in the graph below so you can see which one comes out ahead based on the amount of money you spend annually.

A note on methodology: Because cash back rewards rates vary based on what you're buying, we used a weighted basket to represent the average cardholder's monthly spending:

This basket represents up to $60,000 of spending, beyond which all purchases are categorized as 'other'. After all, most families only spend so much money per year on gas, groceries, and recurring bills, no matter how big their budget is. We also included the annual fees on each card and stripped out introductory or promotional offers. Now you can get a better idea of how each card will reward you over the long term.

The graph is clear: premium cash back offerings come out ahead if you spend more than $20,000 per year on your card. If you spend less, lower-tier cards with no annual fee are a better option.

50+ trusted partners (and growing) on our site to compare mortgage rates, insurance and credit cards

$1 billion+ saved in interest and fees

14+ million Canadians helped per year

Looking for more credit card info? Check out our Help Centre.

The appeal of a cash back rewards card is easy to understand. Who doesn't like earning cash as they spend money on their credit card? With better cash back credit cards available today than ever before, it's easy to find the perfect card — especially if you compare your options right here at LowestRates.ca.

LowestRates.ca may receive compensation when you click on links to those products or services; however, our content and calculations are objective and free from bias. The opinions expressed are purely those of LowestRates.ca; thus, partners are not responsible for any editorials or reviews that may appear. For current term and conditions on any advertiser or partner’s product, please visit their website.

Financial Literacy

Financial LiteracyThis article has been updated from a previous version. Take a second to think about how you do your everyd...

Lifestyle

LifestyleWith temperatures rising, you may be tempted to leave the congested city for greener pastures and wider landscapes. It&r...