There are nearly 100,000 unoccupied homes in the GTA. What's going on?

By: John Shmuel on April 5, 2017

The Greater Toronto Area has a ton of unoccupied homes. And it may be saying something sinister about the area’s housing market.

Last week, Mayor John Tory raised the issue when he said that the city is considering taxing unoccupied homes as a way to solve Toronto’s runaway housing market, where we learned Wednesday prices saw a record-shattering 33% annual increase.

In Toronto proper, Statistics Canada shows that there are some 65,000 unoccupied homes. Over at the Toronto Star, we’re told that this includes potential foreign buyers, but that’s actually not the case — the Statscan data only includes responses from residents. So the unoccupied number is likely higher.

What’s going on here — why are people buying homes and not bothering to live with them or even rent them out?

The team at real estate blog Better Dwelling have some insights.

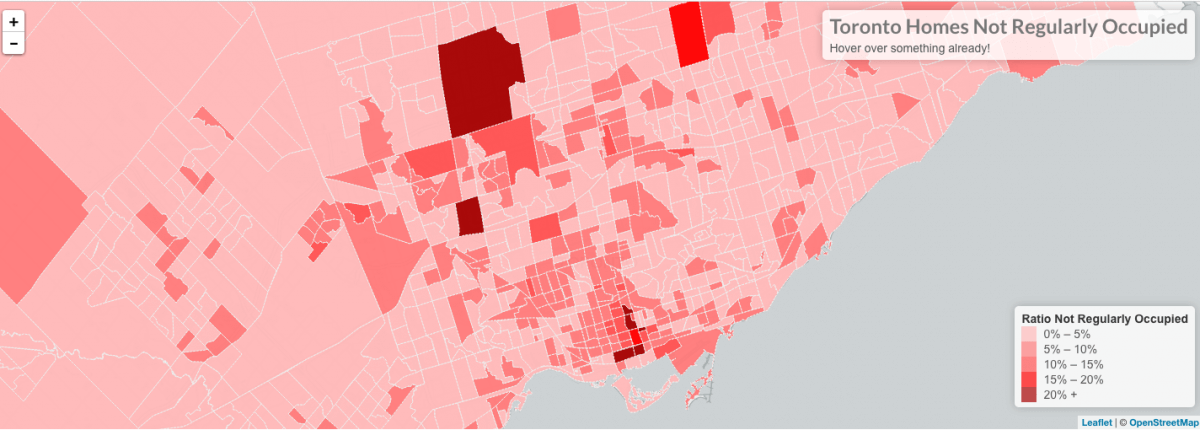

They took on the task of mapping out where the nearly 100,000 unoccupied homes are in the GTA. As you’ll notice, many of the hot zones — where more than 20% of dwellings are unoccupied — are in the downtown core.

What’s causing this? Are snowbirds buying these properties and leaving south to winter in Florida? Is modern life so chaotic that people buy homes and forget to move out of their rentals?

No. As Better Dwelling points out, this is a sign of good, old fashioned speculation.

A large percentage of Canadians in the GTA are no longer buying homes to live in them or even to rent them out while they appreciate in value.

They’re straight up buying homes with the expectation that prices will go up quickly — leading to a hefty profit.

If you run the numbers, real estate has been an unprecedented investment for the average Canadian (with all due respect to the 1980s housing bubble). If you bought a home of any type in the GTA last March and sold it this March, you averaged a 33% return. Did you buy a home for $1 million? Well, in 12 months, you made $330,000.

Real estate speculation tends to run rampant in housing markets that are caught in a bubble. We saw this exact same thing during the 2006 housing bubble — in cities like Miami, Las Vegas and Phoenix. Average Joes were leveraging up with multiple properties and bragging about their impending payday (which for many, never came).

But as we learned back then, it was all a fake wealth effect. People can create their own demand by buying two, three, four properties.

If up to one-third of the market is speculators scooping up homes, we might not even have a supply problem that economists keep harping on about.

We may just have a bubble problem.

432e.jpg)

b188.jpg)