Car insurance prices rising in Ontario and Alberta, falling in Atlantic Canada

By: John Shmuel on May 2, 2018

Car insurance prices in two of Canada's most populous provinces are on the rise.

The LowestRates.ca Auto Insurance Price Index shows that drivers in both Ontario and Alberta saw the average price of their quoted car insurance premiums increase in the first quarter of the year. The index tracks data from the millions of Canadians who have used the LowestRates.ca auto insurance quoter, which is created in partnership with Applied Systems Canada.

This year, for the first time, prices in Atlantic Canada are also being tracked. Our data shows that drivers in the four Atlantic provinces — New Brunswick, Nova Scotia, P.E.I. and Newfoundland and Labrador — saw the average quote fall in the first three months of the year. More on that later.

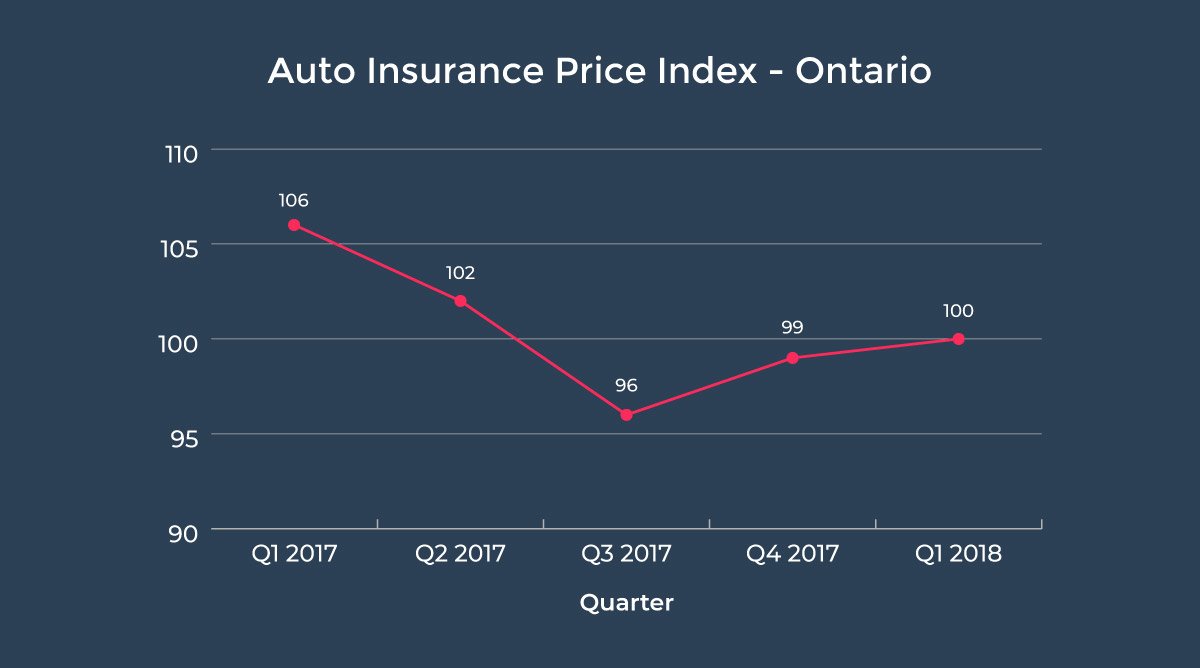

Ontario sees rising prices after a year of declines

Car insurance prices in Ontario were in decline for much of 2017.

In Q1, however, prices rose by 1.08%. This is a more recent phenomenon and reflects rising costs for the province's insurance companies. There are several reasons that could explain why this is happening.

The Financial Services Commission of Ontario, which regulates insurance in the province, says that it's watching two trends. First is the rise in distracted driving — more and more people are texting or checking their phones while they drive, leading to accidents. Second, new cars are becoming more expensive to repair because of all the technology they're loaded with. This makes accident claims more expensive too — and leads to higher insurance prices.

There is also fraud. In November, insurer Aviva found that the average Ontarian pays $100 to $150 a year more than they have to because fraud is rife in the auto industry.

Prices continue their upward march in Alberta

Prices in Alberta have been steadily rising for the past five quarters. In Q1, the average price rose 2.46%.

Let's back up for a moment to see why this is happening. The average driver in Alberta paid $1,179 for a car insurance premium in 2017, according to a report by the Ontario Ministry of Finance. That's 23.6% higher than the Canadian average of $930, but lower than the Ontario average of $1,458.

Alberta no doubt faces many of the same challenges that Ontario does — issues such as fraud, where doctors, mechanics, lawyers and tow truck drivers may work to defraud insurance companies. Fraud can take the form of a dishonest doctor billing for injuries that didn't happen, or a mechanic claiming insurance money for new parts when used parts were installed in the vehicle.

Because Alberta's car insurance prices have been, on average, much lower than Ontario's, we may see the gap close as the issues that have affected Ontario now impact drivers in Alberta.

.jpg)

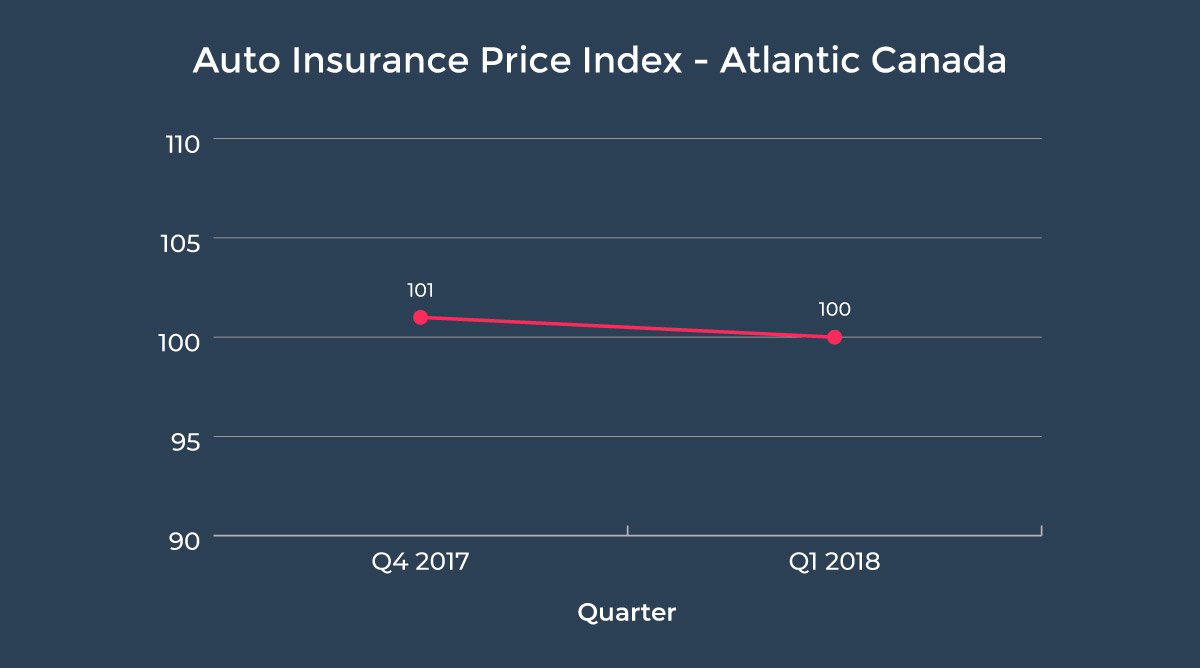

Atlantic Canada sees prices fall, but it's too early to call a trend

This is the first time our report features data from Atlantic Canada. LowestRates.ca launched our insurance quoter for East Coast drivers back in October 2017, so there are only two quarters of data available so far.

Nevertheless, prices in Q1 fell by 0.86% when compared to the previous quarter. A good start. But it's also possible the quarter is an outlier, and the broader trend is upward.

We'll get a clearer picture as we release the rest of our reports this year.

The verdict

It's clear that in Ontario and Alberta, among the two biggest insurance markets in the country, prices are rising.

One thing our index shows is the value of comparing car insurance. While the average quoted price on LowestRates.ca for Ontario drivers rose 1.08% in the first quarter, that was less than the amount insurers were approved to raise rates. The Financial Services Commission of Ontario, which regulates auto insurance in the province, approved insurance providers for an average 2.23% rate increase in Q1.

Going even further, when you break down that 2.23% number, you see some insurers were approved for even larger increases. Sonnet Insurance, a direct-to-consumer player who has undertaken a big marketing campaign to get drivers onboard, raised its insurance prices by 10% for both new clients and those who renew.

So the data is clear — it pays to compare.